ICRFS™ can be readily used as a risk capital management tool without any impact on existing reserving methodologies.

Our clients using ICRFS™ in this capacity, use their preferred reserving methods/tools in their reserving teams. The enterprise risk teams identify PTF models on the portfolios and design forecast scenarios that match the total held reserves. The MPTF modeling framework takes the individual PTF models and includes the correlations, as estimated from the data, and any common drivers between portfolios. All estimates, trends, volatility, correlations, are always derived from the data.

Finding the trends that match held reserves is simply a matter of adjusting the base scenario. ICRFS can do this automatically from a base forecast scenario and a target total mean reserve.

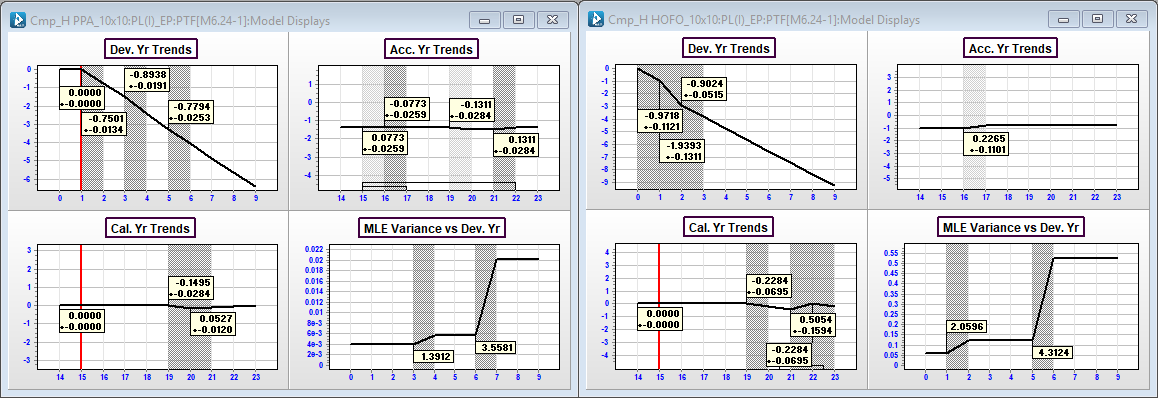

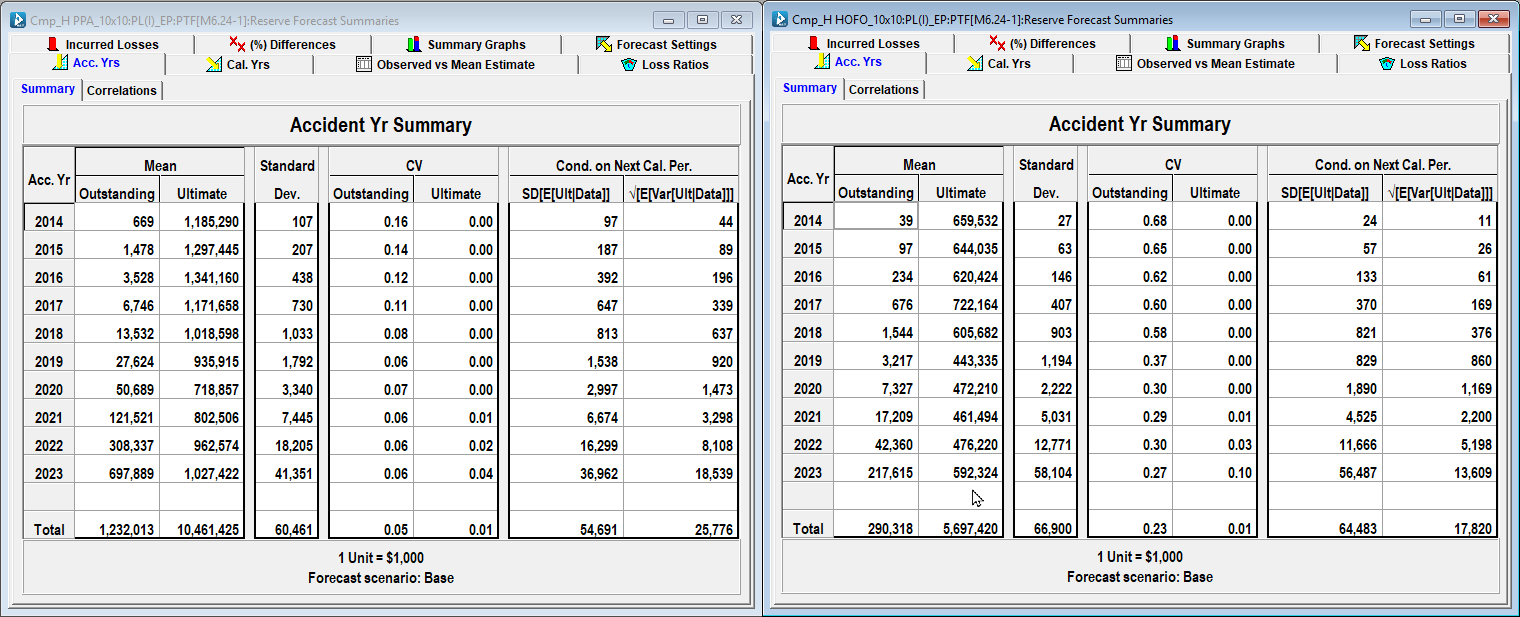

Take for instance, the two Lines of Business (anonymized) for Homeowners (HOFO) portfolio and Private Passenger (PPA) portfolio. The trends and volatility are identified separately for each line as shown below.

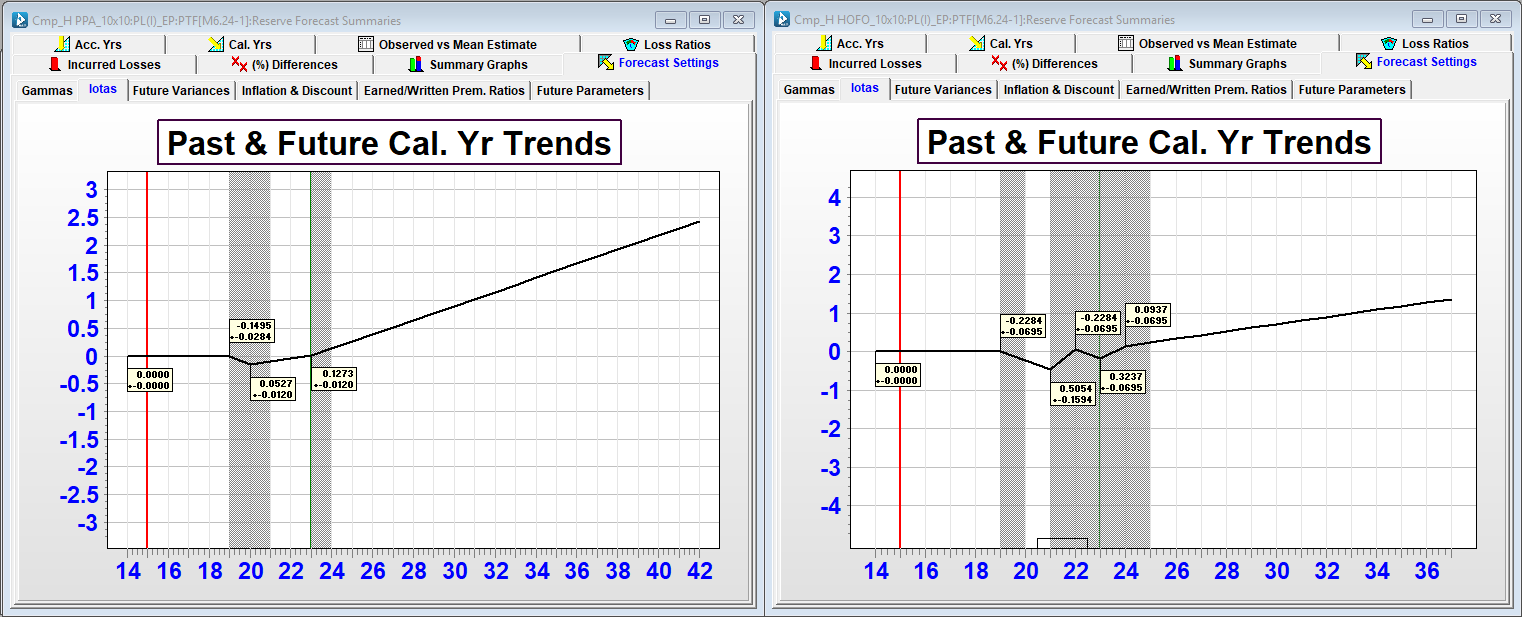

The trends and volatility are unique to each line. Let’s say for this example the future PPA trend is assumed to be 5.27% +_1.2% as measured in the data and the future HOFO trend is assumed to be +23%+_ then zero (basically correcting for internal claims handling and COVID related effects).

The estimated total mean reserves for the base scenarios described above are 1,220M for PPA and 290M for HOFO respectively. A breakdown by acccident period for both portfolios is shown below.

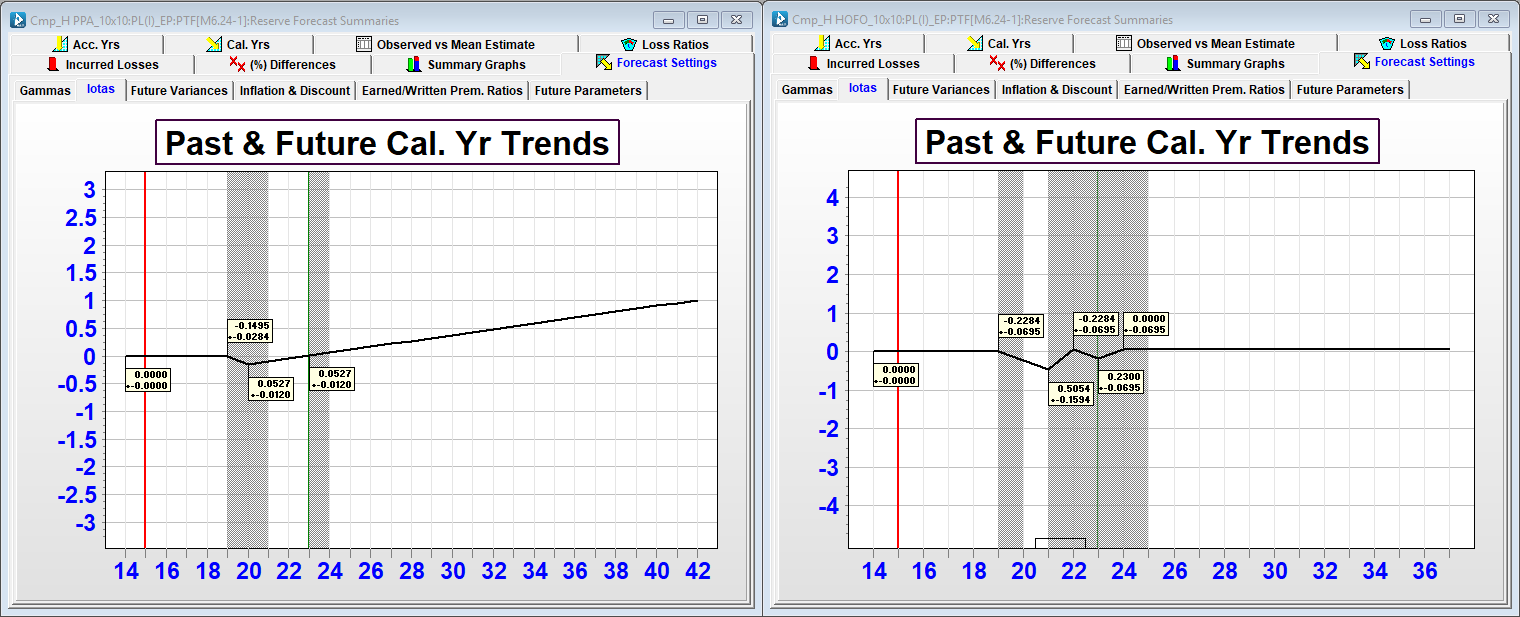

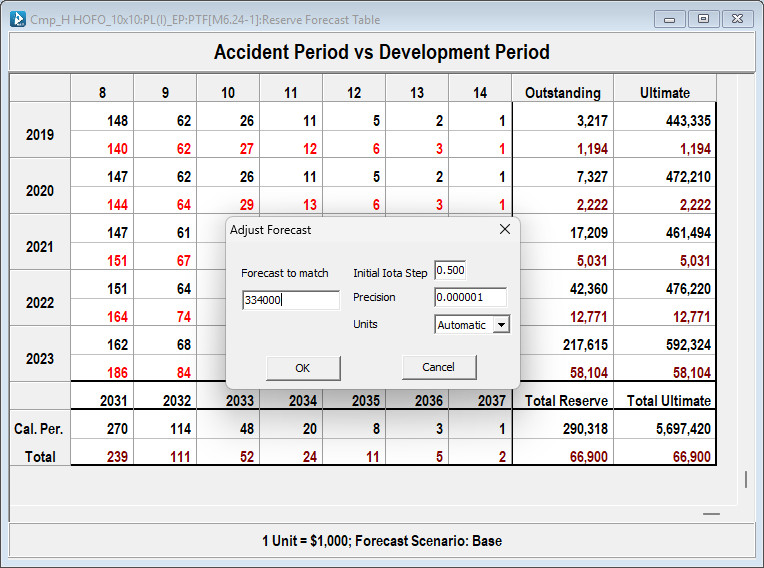

The actual reserves held for these two portfolios are 1,426M for PPA and 334M for HOFO. The estimates of reserves held are conservative relative to the base trend assumptions. ICRFS™ can determine the adjustment required to the selected trend so that the total mean reserve in each line is set to the reserve held. Below is an example for this process with the HOFO book.

For PPA this means assuming the future calendar year trend is 12.7% where the historical trend since 2020 is only 5.27%. For the HOFO portfolio, each trend is increased to 32.4% then 9.37% thereafter. See scenarios below.

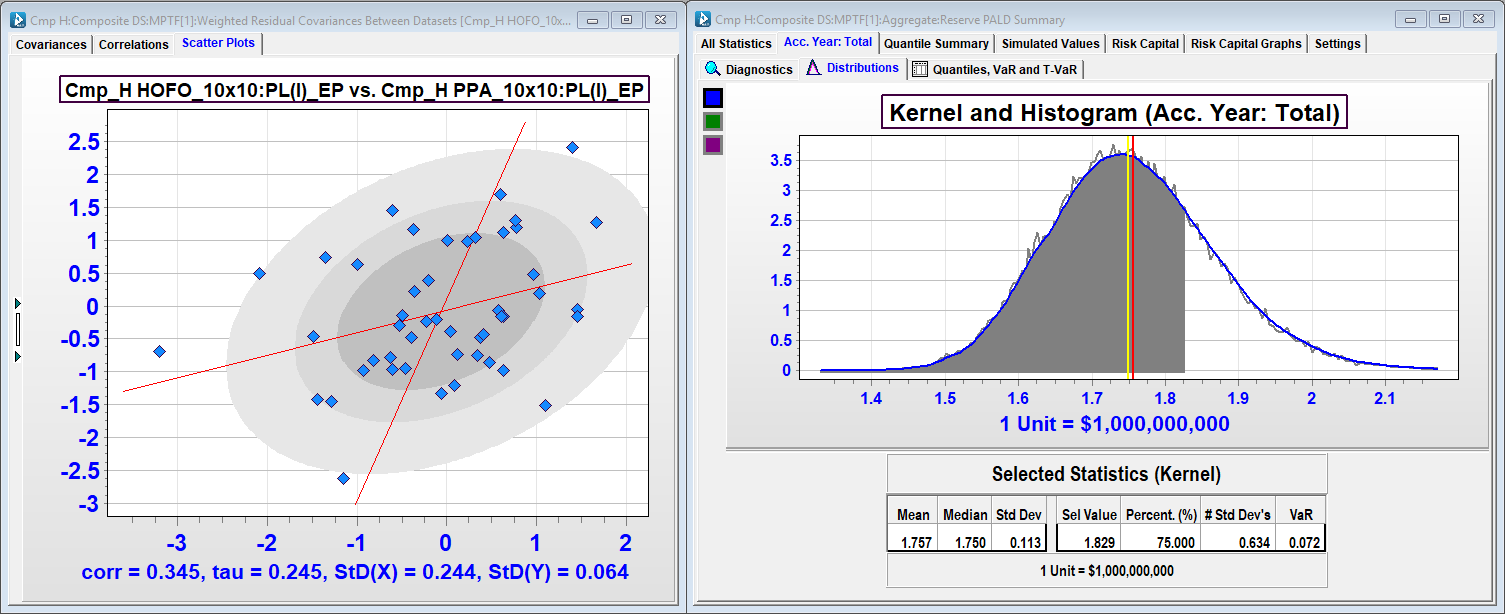

Correlations (volatility, parameter, and reserve) and common drivers can be investigated and incorporated within the MPTF modeling framework. The total reserve distributions for both lines incorporate all measures derived from the data. Below are the volatility correlations estimated from the residuals of the two respective lines.

Risk capital calculations are then based on original reserve distribution assumptions for the individual lines and correctly reflect the diversification credit from writing the lines. The risk capital level can be selected according to regulation specifications (eg: 99.5th percentile of one year reserve risk, 75th percentile of total reserve risk [shown above])

In addition to the risk capital management tools above, the MPTF modeling framework in ICRFS™ also provides insights into Variation in Mean Ultimate, Reinsurance, Solvency II capital requirements and much more. See One Single Composite Model summary advertisement.

Above we illustrated concepts for two lines. The number of lines / segments in MPTF is not limited. Insureware has run composite models in excess of 200 lines.