ICRFS™ 2025 includes a very flexible reinsurance module for designing ADCs and LPTs.

Reinsurance can be prospective or retrospective. Furthermore, quota share can apply to any layer with any number of capital providers.

Any combination of reinsurance contracts, either LPTs or ADCS, can be created for single LoBs (PTF) or multiple LoBs (MPTF). Contracts can be chained, pooled, and layered.

Reinsurance contracts:

- May be monitored of time as the start point of a contract may be historical;

- Contain non-contiguous accident (or underwriting) periods;

- May contain any number of layers (previously maximum was 3);

- Consist of any number of [nameable] capital providers (previously restricted to insurer/reinsurer/retrocessionaire);

- Quota share can be individualized for each contract;

- May be chained between multiple contracts – allowing ‘what if’ analyses where multiple layers of reinsurance may apply (for instance at the line of business level and company level)

- Previous versions of reinsurance are automatically transferred to the new format on loading.

Examples of applications of the Reinsurance module are illustrated below.

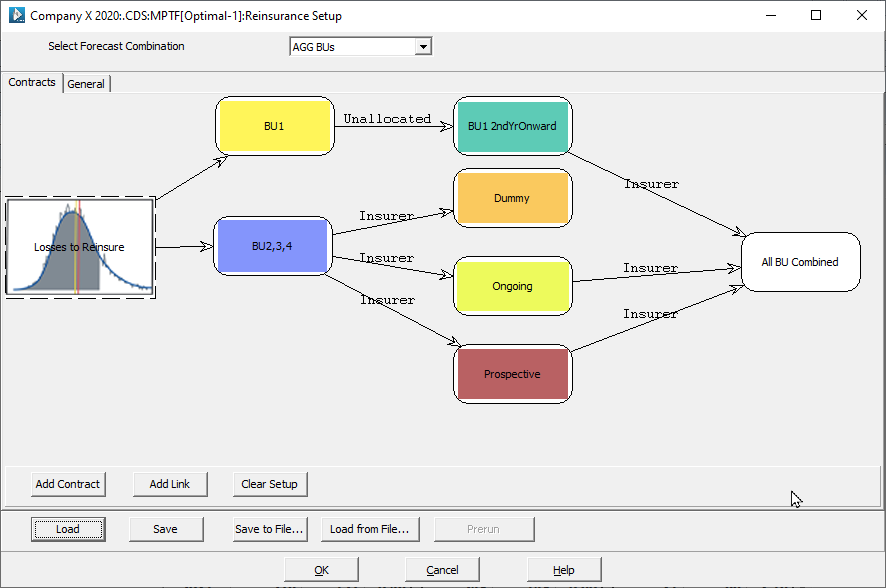

Reinsurance diagram

Below is an example of a Reinsurance contract flow illustrating various types of layered contracts.

1. BU1 [Yellow]

This contract applies to Business Unit 1, First calendar year only. The second and following calendar years are not allocated within the contract and simply flow out as 'unallocated' to the next contract, BU1 2ndYrOnward.

2. BU 2,3,4 [Blue]

This contract is a simple ADC type contract on all accident years applying to the business units 2, 3 and 4. This contract has been active prior to the current valuation year.

3. BU1 2ndYrOnward [Teal]

This contract applies to Business Unit 1 after the contract, BU1, has been processed. As BU1 only operates on the first calendar year, in effect this contract applies to the second calendar year onward (thus the name).

4. Dummy [Orange]

This contract is here for illustrative purposes only. The contract allocates all losses to the Insurer layer. In practice this is unnecessary to include as any simulations that are active from the initial 'Losses to Reinsure' entry point automatically flow to the final 'Aggregate' in the summary according to the last allocation to a capital provider.

5. Ongoing [Green]

This contract take some accident years from the insurer layer after the contract, BU 2,3,4, has been processed. This contract was bought at the same time as the BU 2,3,4 contract and offers additional protection for a subset of the accident years.

6. Prospective [Red]

This contract is being proposed. The first calendar year is after the current valuation period and covers the insurer layer after BU 2,3,4 has been applied for accident years not in (4) or (5). In the previous valuation period these accident years would have been included in (4).

7. All BU Combined [White]

This contract is another proposed contract taking the insurer layer from multiple contracts (3), (5), and (6). In this last contract we have:

- Multiple attachment points

- Multiple capital providers, and

- Varying quota share

Reinsurance not only handles typical Adverse Development Cover on an entire book of business (whether prospective or retrospective), but also can handle a myriad of additional structures of LPTs, Adverse Development Covers, or a combination thereof.

Reinsurance contracts can be monitored over time as new diagonals are added by setting the first calendar year in the contract to refer to historical calendar periods. In this way, gross data can be modeled and Reinsurance arrangements (ADCs) can be evaluated for capital efficiency and cost benefit analysis.

- Groups of Accident/Underwriting periods can be split into separate contracts

- Periods do not have to be contiguous

- each contract can specify:

- number of layers

- proportions taken by each layer; quota share contracts (potentially varying by layer)

- calendar periods the contract applies for

- applicable discount rates

- calendar periods can now be set to begin in historical periods (ie preexisting Reinsurance contracts if modeling gross data)

- reinsurance settings can be saved into the ICRFS™ database associated with forecasts

- Calendar year liability streams Net of Reinsurance along with the total distributions Net of Reinsurance are calculated

Reserve positions Net of Reinsurance

Accident years with no Reinsurance cover can still be included in the analysis so the reserve position Net of Reinsurance studies can be calculated. When constructing the contract, simply set the Insurer to take 100% from each layer.

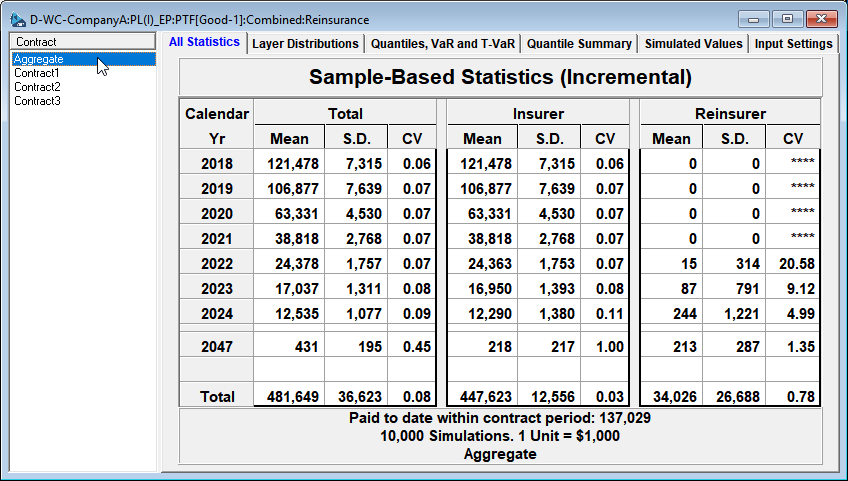

Distributions by calendar year and total, including V@Rs and T-V@Rs, are supplied (along with simulated values for further post processing if required).

Monitoring existing Reinsurance contracts

As Reinsurance contracts now allow the user to set which calendar year the contract begins in - including historical periods - this enables transparent monitoring of contracts. As the data are updated for a new diagonal, the Reinsurance module automatically allocates the losses into the correct layer based on the 'from inception' contract.

Output from the Reinsurance module is summarised in total (Aggregate) and for each contract.

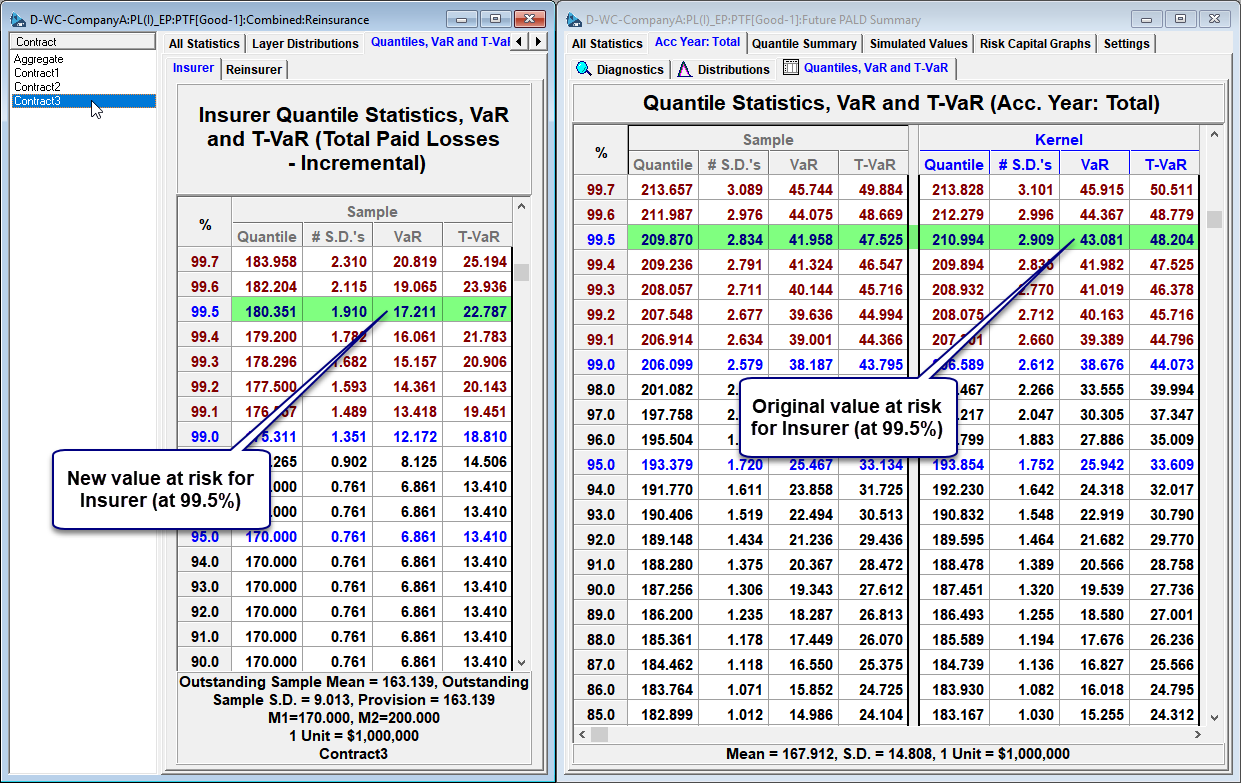

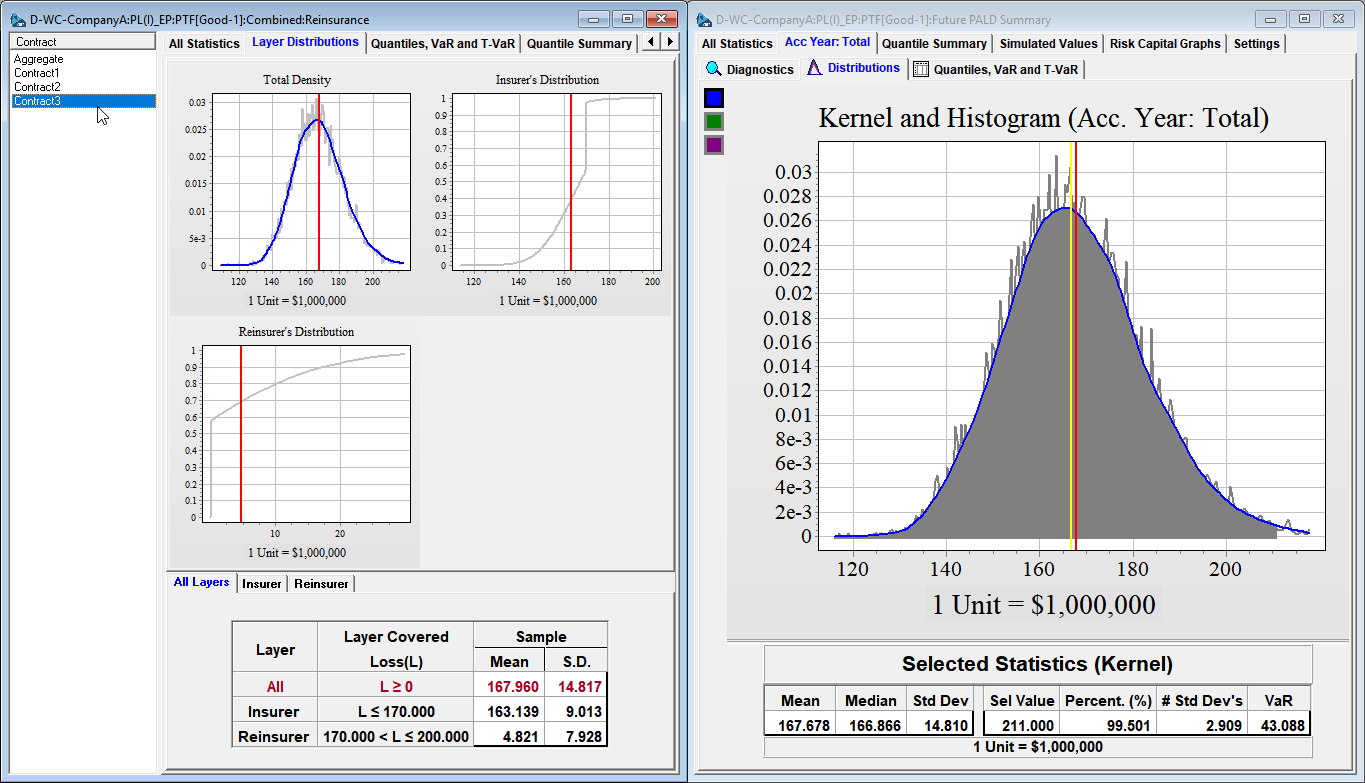

All summary statistics (Quantiles, V@Rs, T-V@Rs) and simulated values are available. ICRFS™ 2025 calculates these metrics for the Aggregate of all contracts and for each contract. For prospective adverse development cover - distributions can be compared with the PALD module to show the reduction in risk capital required by the insurer should the adverse development cover be purchased.

The insurer's loss distributions can be compared between the total loss distribution (below right), and the new loss distributions (below left).

What input is required into the Reinsurance module?

A single composite MPTF model is identified from the data, for multiple LoBs, that measures the volatility (and trend) structure in each LOB and the volatility correlations between the LoBs.

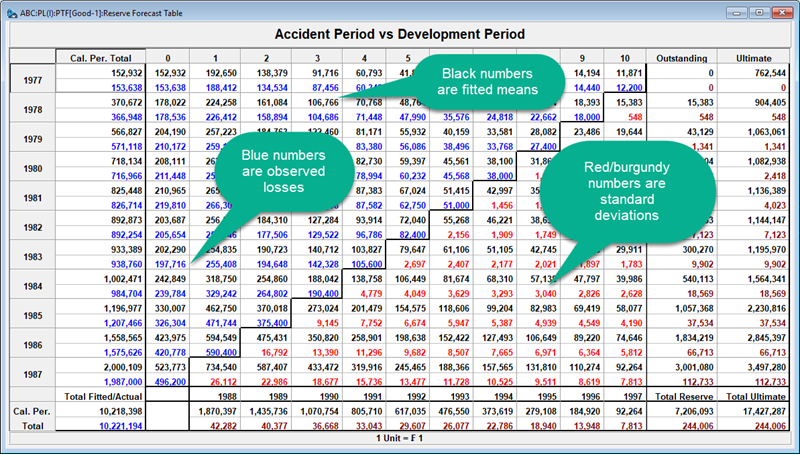

In essence, on a log scale, a normal distribution is fitted to every cell in the loss development arrays and the means of these distributions are related in the identified trend structure.

In respect of projections for future years a lognormal distribution is forecast for every cell using explicit, auditable assumptions for each LoB.

Given that there is no closed analytical distribution for the sum of lognormals, to find the distribution of the aggregate of lognormals we simulate from each lognormal also giving consideration to their correlations.

The simulations from the lognormal distributions are the input into the Reinsurance module.

An example of the forecast table with the forecast lognormal distributions (mean and standard deviation) is shown below.

For more information see the reinsurance brochure on the brochures page.