The IFRS 17 Accounting Standard has had a significant effect on the way that all insurers treat their asset and loss portfolios.

At Insureware we are working to ensure that our reserving and risk management products are fully adapted to the IFRS 17 specifications. The requirements affecting non-life insurers are largely incorporated into ICRFS™ data-handling, analytics content production, and separation of earned and unearned. The remainder are due to come on line in ICRFS™ 2020 and its successor.

What is already available:

ICRFS™ model/forecasts project the full calendar period liability stream in distributional form and allows for fair value discounting.

Forecasting is scenario-based and allows for rapid recalculation of outcomes under alternative assumptions.

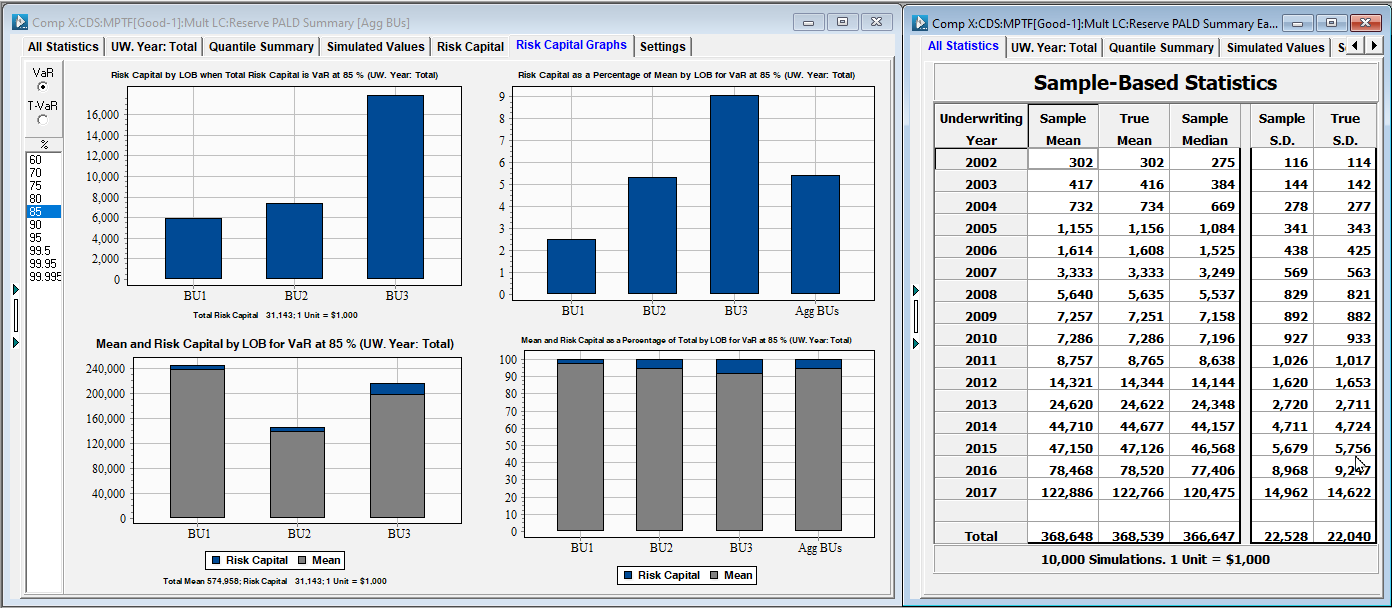

ICRFS™ Solvency II module computes a fully parameterisable market value margin (MVM) based risk charge and economic balance sheet for multiple lines under multiple scenarios, including correlation matrices. IFRS 17 mandates risk capital provisioning but does not specify a method for its calculation. There are several reasons why the Solvency II risk model is an excellent choice here, but alternatives can also be supported using the full power of ICRFS™ simulations.

Governance: When used on a network with a central server, ICRFS™ provides for rights assignment to users, who can either make no changes, changes only to models and forecasts, or changes to models, forecasts and data. The database administrator (DBA) assigns rights to each user in respect of each portfolio and also maintains an access log identifying all actions by users.

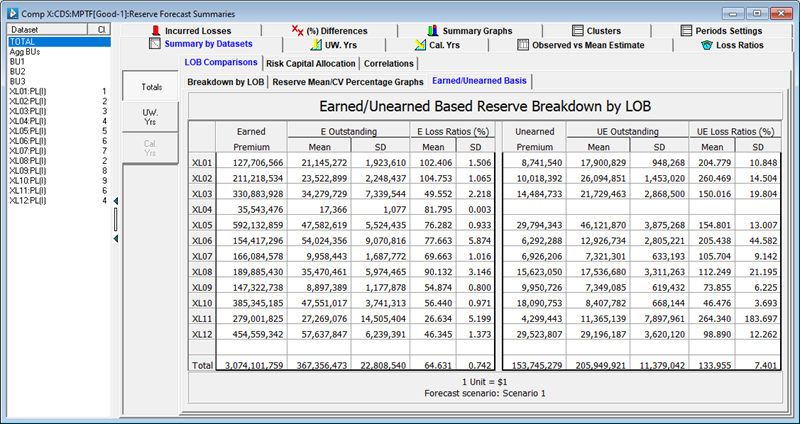

The IFRS paradigm makes a sharp distinction in the treatment of losses projected from expired and unexpired premium, that is losses resulting from events that have already occurred (even if not yet reported) and those that will result from events that have not yet occurred but which fall under active contracts. In non-life insurance this distinction mostly affects the current underwriting year. ICRFS™ forecasts are adapted to the grouping of contracts by underwriting year and can be spilt by the ratio of expired to total premium.

Governance: Restrictions on data access are further tightened by the ICRFS™ Open Data Architecture (IODA). IODA keeps data within the data warehouse in tables readable by ICRFS™ (or any other service provider). These tables are queried on the fly to produce data for modeling and are not modifiable by the ICRFS™ platform. Only suitably authorized personnel with direct access to the database are able to write to the IODA data tables.

Accounting basis types are being added as a native feature of the triangle group (and all objects therein). Available bases are: accident, occurrence, report, claims made, underwriting and policy. When defined at the triangle group level, all subsequent modules reflect the basis type in tables, charts, and dialogs.

Both written premium and earned premium can be associated with a dataset. The PTF and MPTF modeling frameworks will utilize these premium vectors to create summary tables detailing the allocation of earned and unearned risk. Our simulation module (Predictive Aggregate Loss Distributions - or PALD), provides options to simulate total risk and earned risk.

The bootstrap technique is being extended to all ELRF model families providing fuller support for actuaries (or auditors) needing to make use of the bootstrap. The algorithm has also been significantly enhanced.

Risk capital should always be allocated based on the ultimate written premium - not just the proportion earned to date. Accordingly, when we produce simulations for future losses, we only calculate risk capital allocation for the written premium. All other metrics are calculated for the earned - see below.