Best's Financial Suite P/C, US and

Insureware's Analytical Tools: Data

Insureware and AM Best have created ELRF™ Best’s Schedule P 2023.

This application, complimentary with a Best’s Financial Suite - P/C, US subscription, is:

- pre-loaded with Best’s Financial Suite - P/C, US data;

- organized in a structured database; and

- primed for Insureware’s analytical tools and modeling frameworks!

Insureware has created ICRFS™ Best’s Schedule P 2021 as a premium application for those who have installed ELRF™ Best's Schedule P. This application adds the innovative probabilistic modeling frameworks of ICRFS™ to the functionality of ELRF™ Best’s Schedule P 2021.

You can find our brochure here.

Insureware Best’s Schedule P 2021 products provide:

- Pre-calculated critical financial information by

Company, Line of Business, and Total:

- Reserves Held;

- %IBNR;

- Total Loss Ratio;

- Survival Ratios;

- % Premium Ceded;

- Total Earned Premium; and

- Many more!

Drill down by key financial metrics and glean hidden insights.

All available Best’s Financial Suite - P/C, US loss development arrays (triangles):

- Paid losses;

- Case Reserve Estimates (CRE);

- BULK and IBNR;

- Incurred Losses;

- Number of Claims Reported;

- Number of Claims Closed.

- Reserves Held = Case Reserve Estimates + BULK and IBNR; and

- Ultimates Held = Incurred Losses + BULK and IBNR.

Construct a complete picture of a company’s reported liabilities, their holdings, and their financial positioning in the industry.

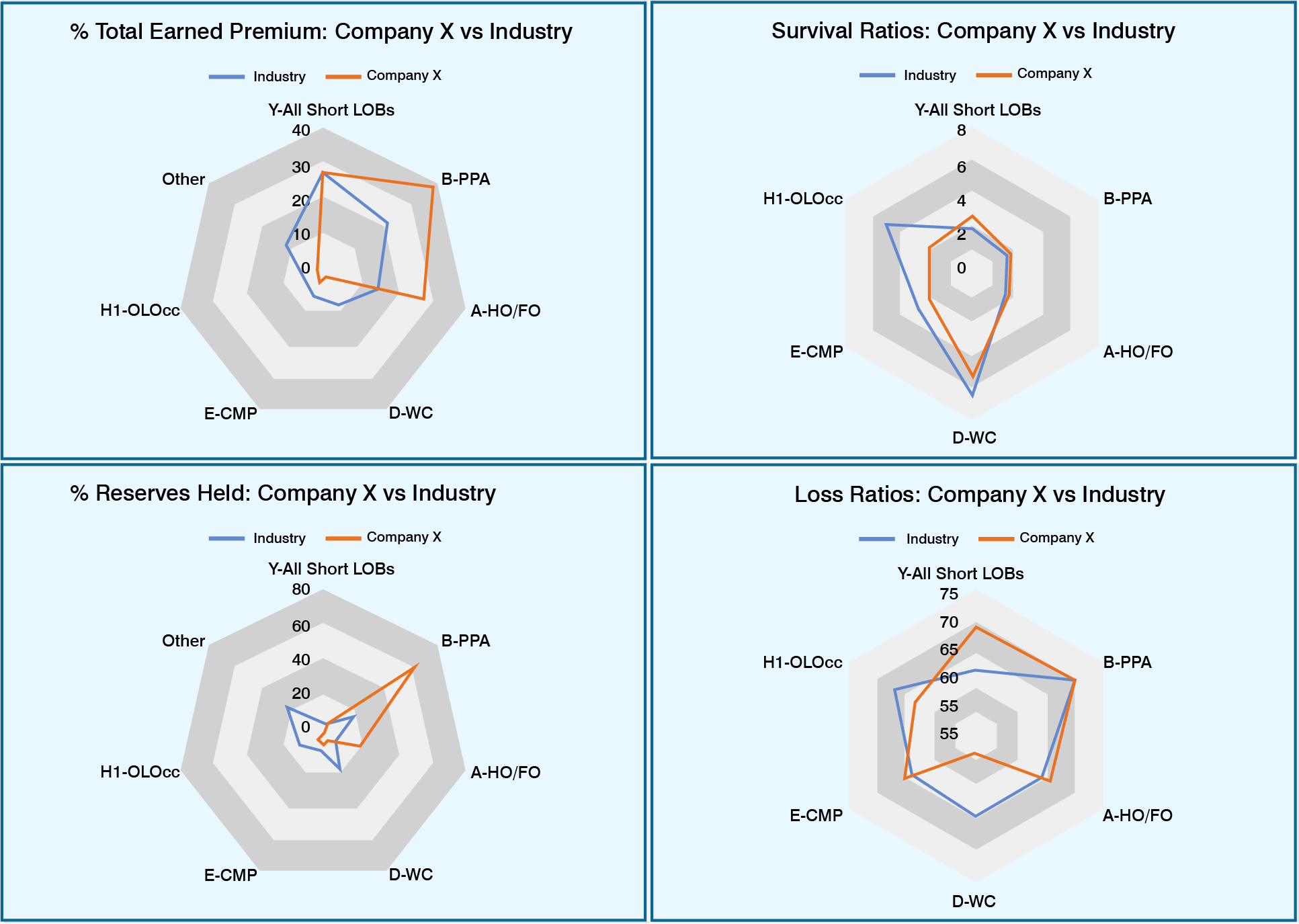

Company vs Industry snapshots at a glance

ICRFS™ Best's Schedule P includes a COM API allowing extraction of the pre-calculated metrics directly from the ICRFS™ database.

Left are four metrics for the Best's Financial Suite P/C, USA data for the industry:

- % Total Earned Premium;

- Survival Ratio;

- % Reserves Held; and

- Loss Ratios

Overlaid on the same plots are the corresponding metrics for Company X.

Immediately evident is that Company X's primary earned premium source are the lines:

- Short Tail;

- Private Passenger Auto (PPA); and

- Home Owners/Farm Owners (HO/FO).

While percentage of premiums associated with short tail line are consistent with the industry, this company focuses on the Private Passenger Auto and Home Owner/Farm Owner lines.

It is no surprise then, that this company allocates most of its reserves to the PPA and HO/FO Lines of Business.

What may be concerning, is that this company's surivival ratios are less than the industry for the Lines of Business that do not form its main exposure source. Especially for this Company's Worker's Compensation segment where the Company's Expected Loss Ratios (approx 50%) are well below the industry average (65%).

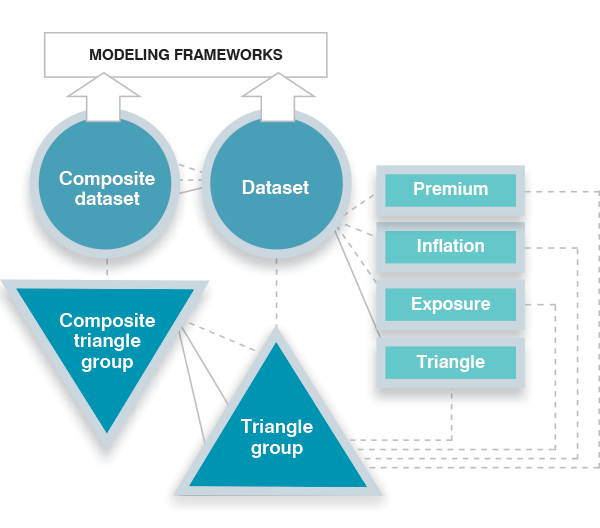

Data Organization

Best’s Financial Suite - P/C, US data are grouped by company and Line of Business into triangle groups. In Insureware parlance, triangle groups contain data (triangles, premiums, exposures, models, and more) related to the same Line of Business – or other grouping category. These building blocks are then provided to the modeling frameworks for analysis.

Triangle groups contain building blocks for easy analysis:

- Triangles (loss development arrays);

- Exposure, Inflation, Premium vectors; and

- Datasets which link triangles with [optional] exposure, inflation or premium vectors. Net data are available in triangle format for ready analysis.

When Insureware imports the Best's Financial Suite P/C, US data into the ICRFS™ database, additional metrics are calculated for each Triangle Group. This enables quick filtering within the database to identify company's of interest. Plus, these metrics allow ready comparisons between company's or between a company and the industry.

Best's Financial Suite P/C, US and Insureware's Analytical tools!

Read more about the analytical tools in ELRF Best's Schedule P here.