Long-tail LoB insurance risk metrics

...tailored to your company's experience

Read further to see how Insureware's actuarial loss reserving solutions can help you quickly:

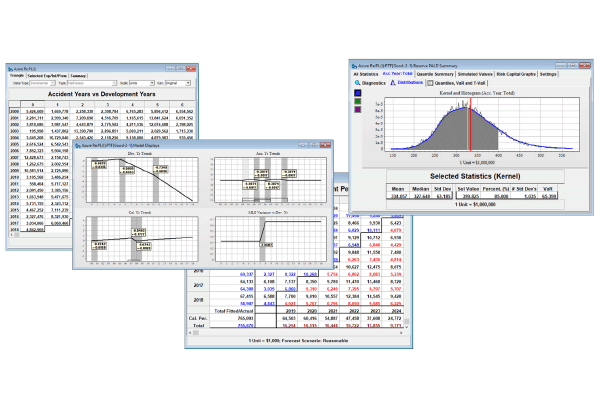

- find the optimal statistical model for individual lines,

- design a single composite model for the whole company!,

- measure Calendar year trends: economic and social inflation

changes, - obtain the right risk metrics for ORSA or Solvency II,

- meet IFRS 17 requirements,

- assess optimal Reinsurance programs,

- calculate reserves net of Reinsurance,

- calculate Risk Capital,

- price and customise risk transfers like ADCs and LPTs,

- test link ratio methods graphically and using the regression formulation,

- have data available for analysis within an easily navigatable database,

- provide solid, supporting evidence.

Need to know what risk metrics should be considered?

Sign up for our free risk metrics guide.

Innovative statistical solutions for P&C re/insurance (long-tail lines)

Insureware's software solutions are:

- small-footprint;

- intuitive;

- very fast; and

- rapidly implemented enterprise wide.

Data, models, and notes are all stored in easy-to-navigate databases.

One composite model for the whole company. Distinguish between common drivers and volatility correlations, parameter correlations, and reserve distribution correlations.

Intelligent modeling wizards quickly generate starting models.

Long-tail liability risk metrics obtained from the modeling frameworks are

customized to your company's experience.

Solutions for Solvency II, ORSA, Risk capital, Net of Reinsurance, and much more!

Make actuarial analysis pleasurable.