Solvency II – one year and ultimate year

risk horizons for long-tail liabilities

- Economic Balance Sheet

- Solvency II Capital Requirement (SCR)

- Technical Provisions

- Market Value Margins (MVM)

- IFRS 17

- Fungibility and Ring Fencing

- Consistency of metrics on updating

- One year ahead metrics

- Variation in Mean Ultimate

You can download this brochure here.

Introduction

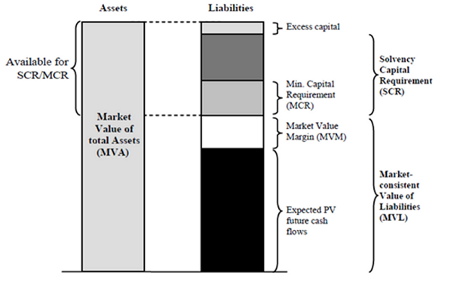

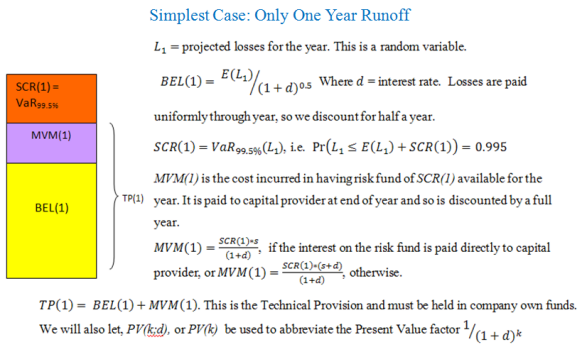

Solvency II aims to establish a solvency regime that is better matched to the true risks of an insurance company. For long tail liabilities, the regime attempts to provide a 'fair value of liabilities' measure - the capital required to meet the Best Estimate of Liabilities (BEL) and the cost of raising (holding) risk capital. The sum of the BEL and Market Value Margin (MVM: present value cost of raising (holding) capital) is also referred to as Technical Provision (TP).

Economic Balance Sheet showing the components of the liability side

An Economic Balance Sheet is a balance sheet that incorporates Risk Margins (Market Value Margins). Risk Margins are required metrics for Solvency II and IRFS 4 Phase II (see below).

To find out more, you can view our brochure

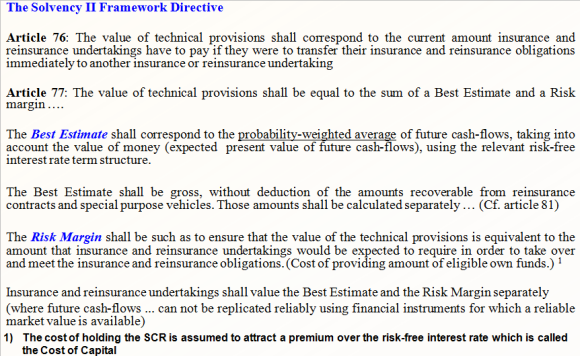

Directives

Consultation paper 75: Undertaking specific parameters for SCR

"3.55. The SCR is the difference between the basic own funds over the one year time horizon in the distressed scenario. This implicitly suggests that the undertakings should analyse the difference between all component parts of the technical provisions under the distressed scenario, including the risk margin."

Solvency II framework directive

Article 101: "The Solvency Capital Requirement (SCR) shall ... correspond to the Value-at-Risk (VAR) of the basic own funds ... subject to a confidence level of 99.5% over a one-year period."

As detailed in the Insurance ERM analysis of Solvency II:

"The concept of market value margin (MVM), and the related one-year risk approach in the calculation of the solvency capital requirement (SCR), find their origin in this fair value driven approach: re/insurance companies should have enough capital on their balance sheet to cover the risks that can emerge over a 12-month timeframe, and allow for a (theoretical) transfer of all (contractual) liabilities at the end of this balance-sheet period. This means that companies have to be able to calculate the impact of such shocks on their end-of-year balance sheets, and value these in such a way that they can be transferred to a third party."

As detailed on the CFO forum, a Market Cost of Capital approach to calculating Market Value Margins (MVMs) is endorsed. See the paper here.

"The CRO Forum endorses a MCoC approach to calculating the MVM. For non-hedgeable risks, this approach ensures that both assets and liabilities are valued in a manner consistent with hedgeable risks. Under this approach, the MVM for non-hedgeable risk is calculated as the present value of the cost of future capital requirements for non-hedgeable risks."

Definition of Solvency Capital Requirement (SCR)

The above extracts lead to the following definition: the SCR for the one-year risk horizon is the Value-at-Risk for the first year plus the change in technical provisions (TP) in the subsequent years (suitably discounted), conditional on the first year being in distress.

SCR = VaR99.5%(1) + ΔTP(2) + ΔTP(3) + ... + ΔTP(n)

where n is the number of years till run-off.

The first year in distress impacts the subsequent years, that then impact the SCR and Market Value Margin for the first year. There is no recursion.

The SCR is adequate to restore the balance sheet to a fair value of liabilities at the end of a distressed first year such that the portfolio can then be transferred or sold to a reinsurer.

The simplest example - a one-year run off

Members of the Insureware team have published papers in the Solvency II space.

A solution for Solvency II quantitative requirements modeling with long-tail liabilities

Munroe, D., Odell, D., Sandler, S., & Zehnwirth, B. (2015). A solution for Solvency II quantitative requirements modeling with long-tail liabilities. North American Actuarial Journal, 19(2), 79-93.

And:

Solvency capital requirement and the claims development result.

Munroe, D., Zehnwirth, B., & Goldenberg, I. (2018). Solvency capital requirement and the claims development result. British Actuarial Journal, 23.